Shakespeare said, “What’s in a name?” but that’s where many startups get stuck. Almost the same thing happened when ‘Intel’ co-founders Robert Noyce and Gordon Moore, two well-known figures in semiconductor technology, thought of creating a new firm together. The company commenced its operations with the name “NM Electronics” on July 18, 1968, but at the same time, both the founders considered a variety of portmanteaus before they found the one that clicked.

By the end of the month, they changed the name from “NM Electronics” to Intel, which stood for Integrated Electronics. However, the naming ceremony and the tension around it didn’t end there. Soon, the founders found out “Intelco” was already the name of a hotel chain in the Midwest. So, to overcome the new tension, Noyce and Moore paid $15,000 and bought the rights to use the name from that company, as it was easier than coming up with a new name that didn’t already exist.

The Early Days of Intel

Intel’s Genesis Intel emerged from the hands of seasoned technologists, a departure from the common narrative of young founders tinkering away in garages. Robert Noyce, a co-inventor of the silicon integrated circuit, and Gordon Moore, the former head of research and development at Fairchild Semiconductor, laid Intel’s foundation. Backed by $2.5 million orchestrated by Arthur Rock, a pioneer in venture capitalism, Intel took its first steps. Joining the fray was Andrew Grove, a pivotal addition to the trio. Over the ensuing three decades, Noyce, Moore, and Grove took turns at the helm as chairman and CEO, steering the company through its formative years.

The Dawn of Innovation

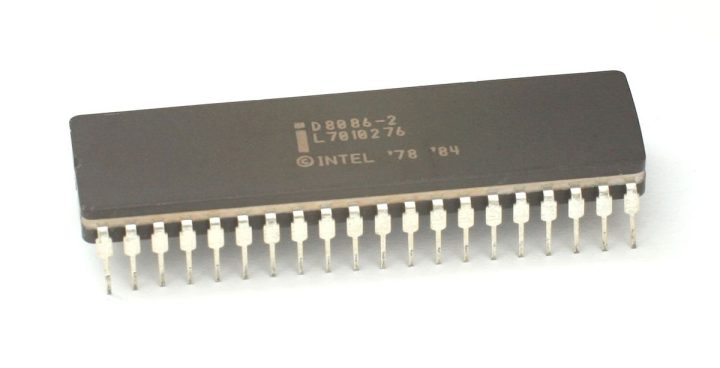

Intel’s initial foray into the market centred on memory chips, with mixed success. While 1101, the world’s first metal oxide semiconductor, faltered, its sibling, 1103, a one-kilobit dynamic random-access memory (DRAM) chip, soared. Honeywell Incorporated’s adoption of the 1103 in 1970 heralded a new era, as DRAMs supplanted core memory, becoming the de facto standard worldwide. This success propelled Intel into the public sphere in 1971. The same year saw the debut of the erasable programmable read-only memory (EPROM) chip, marking another milestone. Additionally, Intel’s collaboration with Nippon Calculating Machine Corporation bore fruit with the creation of the 4004, one of the earliest single-chip microprocessors, setting the stage for Intel’s future dominance.

The Pentium Era

In 1993, Intel departed from its numerical nomenclature with the introduction of the Pentium microprocessor. Boasting parallel processing capabilities, Pentium heralded a paradigm shift, offering unprecedented speed with its 3.1 million transistors. Its potency, coupled with Microsoft’s Windows 3.x, fueled a surge in PC adoption, particularly among consumers embracing multimedia applications. Intel’s strategic focus on enhancing microprocessor performance drove innovation, epitomised by the exponential growth in transistor count, famously known as Moore’s Law. From the humble 8088 to the towering Itanium 9500, Intel continuously pushed the boundaries of possibility.

Diversification and Dominance

By the mid-1990s, Intel had transcended its chip-centric origins, venturing into motherboard production to expedite PC manufacturing. This diversification paid dividends, cementing Intel’s presence in the burgeoning PC market. The new millennium witnessed Intel’s ascent to dominance, with its chips powering the vast majority of PCs worldwide, culminating in a historic collaboration with Apple in 2005. The inclusion of Intel CPUs in Apple’s future PCs closed a longstanding gap, further solidifying Intel’s position as the pre-eminent force in the CPU market.

Leadership Transitions

Intel’s leadership mantle passed through several hands, with Paul Otellini assuming the CEO role in 2005, succeeded by Jane Shaw as chairman in 2009. Andy Bryant took the reins as chairman in 2012, followed by Brian Krzanich as CEO the next year. Bob Swan ascended to the CEO position in 2019, steering Intel through the dynamic landscape of the 21st century. As of April 2024, Intel stood as a stalwart among America’s corporate giants, a testament to its enduring legacy of innovation and adaptation, under the leadership of Pat Gelsinger – CEO and Frank D. Yeary – Chairman of Intel.

Rivals in the Silicon Arena

In the world of PC chipsets, Intel found itself in a competitive dance with formidable adversaries like AMD, VIA Technologies, Silicon Integrated Systems, and Nvidia. Similarly, in the networking sphere, contenders like NXP Semiconductors, Infineon, Broadcom Limited, Marvell Technology Group, and Applied Micro Circuits Corporation vied for a piece of the pie. Flash memory, a critical domain, saw Intel locking horns with Spansion, Samsung Electronics, Qimonda, Kioxia, STMicroelectronics, Micron, and SK Hynix.

At the heart of the x86 processor market, Intel’s primary challenger has long been AMD, with whom it struck full cross-licensing agreements dating back to 1976. This pact allowed both parties to tap into each other’s patented technologies without financial constraints, save for a few stipulations. However, the threat looms large: in the event of an AMD bankruptcy or acquisition, the agreement would unravel.

While smaller contenders like VIA Technologies dabble in crafting low-power x86 processors tailored for compact computing platforms, the landscape has shifted dramatically with the advent of mobile devices, particularly smartphones. The meteoric rise of Arm-based processors, fueling over 95% of the world’s smartphones, poses a formidable challenge to Intel’s dominance. Not content with reigning over the mobile realm, Arm sets its sights on encroaching into the PC and server territories, with Ampere and IBM leading the charge.

Adding to the mix is RISC-V, an open-source CPU instruction set, emerging as another contender. Notably, amidst escalating tensions, Chinese tech titan Huawei unveiled chips rooted in the RISC-V architecture as a response to US sanctions, signalling a potential disruption in the status quo.

The Turn of the Tide

The early 2000s ushered in a paradigm shift as demand for high-end microprocessors plateaued. Competitors, spearheaded by AMD, chipped away at Intel’s market share, leveraging innovative architectures to carve a niche, particularly in the low to mid-range processor segments. Intel’s dominance faced its most significant challenge yet, compounded by the contentious NetBurst microarchitecture. Seeking to diversify beyond semiconductors, former CEO Craig Barrett spearheaded initiatives in the early 2000s. However, these endeavours yielded mixed results, failing to deliver the desired impact.

A Bid for the Smartphone Throne

Intel’s ambitions extended to the market of smartphones, igniting partnerships and investments to establish a foothold. Collaborations with ZTE Corporation and Google signalled intent, with the Medfield processor poised to rival Arm’s dominance.

Intel’s overture to support a spectrum of operating systems, from Android to iOS, underscored its commitment to diversification. Yet, despite fervent efforts, the tide turned. Market shifts prompted Intel to slash its workforce and retract from the smartphone battleground, signalling a strategic pivot in its trajectory.

The 10 largest shareholders of Intel as of December 2023 were:

- Vanguard Group (9.12% of shares)

- BlackRock (8.04%)

- State Street (4.45%)

- Capital International (2.29%)

- Geode Capital Management (2.01%)

- Primecap (1.78%)

- Capital Research Global Investors (1.63%)

- Morgan Stanley (1.18%)

- Norges Bank (1.14%)

- Northern Trust (1.05%)